Cyprus 5% VAT on Property: Old vs New Rules Explained

All buyers and developers who benefited from the reduced 5% VAT rate on the purchase or construction of a primary residence in Cyprus under the old system will retain this benefit only until June 2026. After this date, the transitional provisions of Law 42(I)/2023 will expire, and all new transactions will fall fully under the revised VAT framework.

Under the temporary regime, applicants who submitted building permit applications between 1 June and 31 October 2023 were allowed to benefit from the reduced VAT rate, regardless of when construction would be completed. As a result, the old and new VAT systems have been operating in parallel from 16 June 2023 until 15 June 2026.

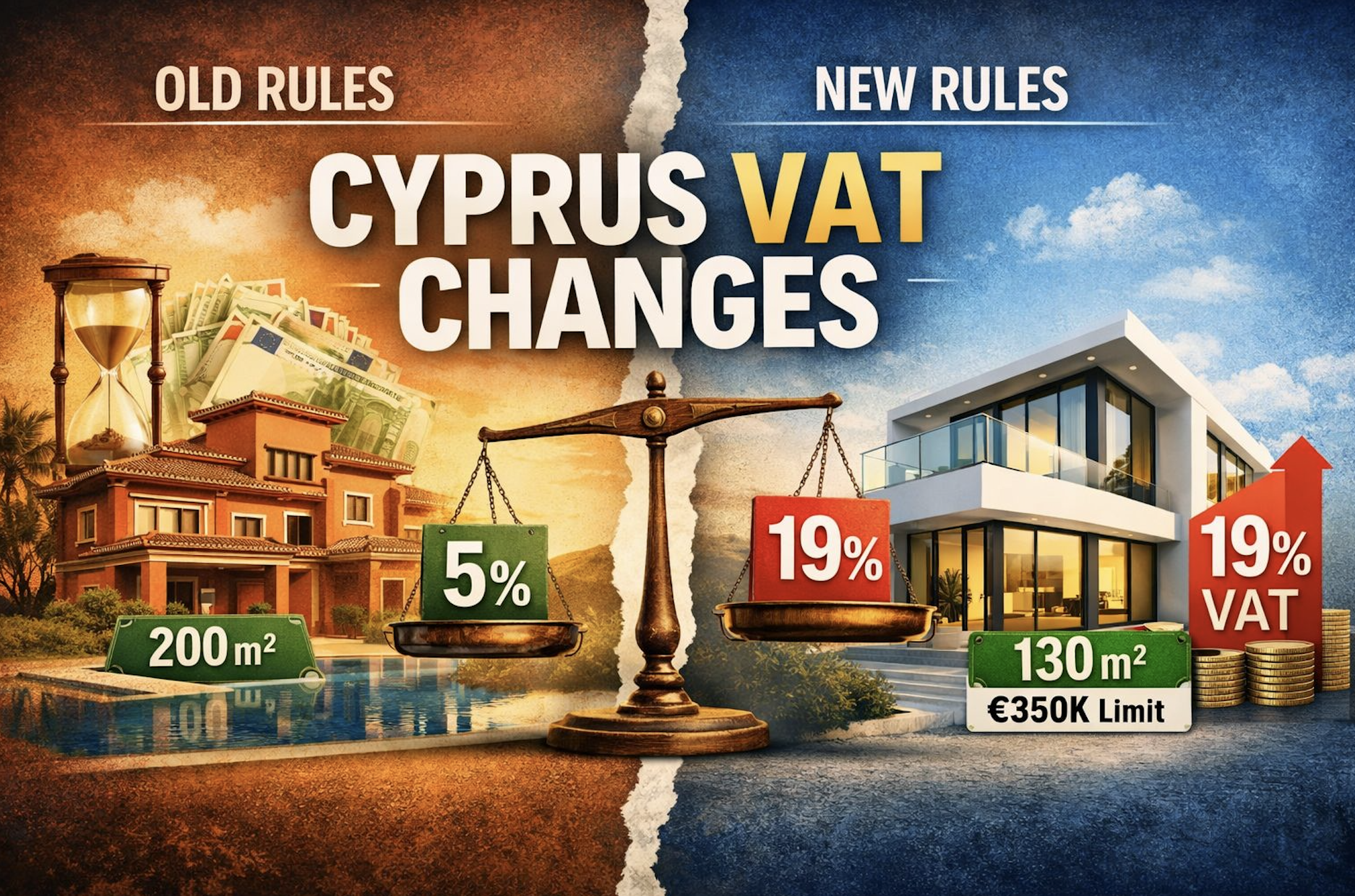

What Has Changed: Old Rules vs New Rules

The previous legislation introduced in 2016 offered very broad eligibility. The reduced 5% VAT rate applied to the first 200 square metres of a residence, without taking into account the property’s total size or value.

However, following pressure from the European Commission, Cyprus was required to revise the scheme to align it with EU VAT regulations.

Under the new rules, the 5% reduced VAT rate applies only if all of the following conditions are met:

It applies to the first 130 m² of the property

The property value must not exceed €350,000

The total covered area must not exceed 190 m²

The total transaction value must not exceed €475,000

Any part of the property exceeding these thresholds is subject to the standard 19% VAT rate.

For persons with disabilities, the reduced 5% VAT rate may be applied to properties of up to 190 m², while the same value limits remain in force.

Increased Monitoring and VAT Repayment

Cyprus’s Finance Minister, Makis Keravnos, has reiterated that property owners who benefited from the reduced VAT rate but failed to use the property as their main residence are required to repay the difference, amounting to an additional 14% VAT.

This measure also affects participants of the now-abolished Citizenship by Investment programme, particularly in cases where properties were purchased for rental income or resale rather than for personal occupation.

Over the past three years, the Cyprus Tax Department has conducted more than 5,000 inspections, uncovering violations totalling approximately €50 million. Most of these cases were identified in coastal and student-populated areas, including Engomi and Aglantzia, where properties were frequently rented out via platforms such as Airbnb.

Voluntary Compliance Scheme

A voluntary disclosure campaign is currently in effect, allowing property owners who no longer meet the eligibility requirements to settle outstanding VAT obligations without penalties.

In cases of financial difficulty, repayment can be made in up to 12 monthly instalments, and in exceptional circumstances, payment deferrals may be approved at the discretion of the Tax Commissioner.

A New Direction for Cyprus’s Housing Tax Policy

This VAT reform represents a significant step toward curbing tax abuse and improving transparency in the real estate sector. From 2026 onwards, the system will be more balanced and targeted, prioritising support for buyers who intend to use their property as a primary residence, rather than for speculative or purely investment purposes.

Property market experts in Cyprus anticipate that demand will continue to grow, particularly in the eco-friendly and energy-efficient housing segment, which remains eligible for the reduced VAT rate. In this way, the reform not only strengthens tax compliance but also encourages the sustainable development of Cyprus’s housing market.